The Importance of Transferring Your Points

If you earn transferrable points with a bank (such as American Express Membership Rewards, Chase Ultimate Rewards, Citi ThankYou Points, Capital One Miles, etc), that means you can leverage your bank’s transfer partners to book nearly free travel. Each bank partners with a number of different airlines and hotel programs, giving you the opportunity to transfer your credit card points to that partner and book travel directly through them! This is often the best way that you can use your points because it maximizes their value.

Note: if your card is co-branded, you cannot transfer your points: you can only use them within the designated loyalty program. We’re often asked “How can I use my Amex Delta miles?” – in reality, there are no Amex Delta miles. Your card is issuer may be American Express, but you’re not earning transferrable American Express Membership Rewards points. Because your card is co-branded with Delta Airlines, you’re earning Delta SkyMiles as a currency, and you can only use those Delta SkyMiles within Delta’s own loyalty program.

However, if you’re earning transferrable points with a bank, then you’re able to redeem those points in a number of ways.

- Using your points as purchase erasure, cashback or statement credits

- Using your points at checkout with particular retailers (such as Amazon)

- Using your points for a variety of gift cards

- Using your points for flights and hotels booked through the bank’s travel portal

- and more!

But by using your points in the bank portal, you’re limiting the value of your points to 1 cent per point (cpp) to 1.5 cents per point maximum. This value may vary slightly depending on which card you have or how exactly you opt to use your points, but it will generally not exceed 1.5 cpp.

1cpp is standard for most cards. Therefore, you can assume that 75,000 points will only get you $750 in value (whether it’s cashback, gift cards, or a flight) if you use them in the bank’s travel portal.

However, this approach doesn’t maximize the value of your points, especially when considering alternative redemption options! For example, you could settle for redeeming your 65,000 sign-up bonus for $650 in the travel portal, or use them at checkout for a $455 Amazon haul, or…

You can those 65,000 points it to book a $4,000+ business class flight.

How?

By transferring your credit card points to an airline partner, then booking your flight directly with the airline.

With that kind of cash price-tag ($4,000+), the same flight would cost you 400K+ points in most banks’ travel portals. In reality, you can book that exact same flight for 65K points by transferring your points to an airline. It’s the option that the bank tells you least about that is most profitable for you!

As an example, let’s look at these Turkish Airlines Business Class flights from Washington, DC to Istanbul, which cost $4,456.30.

In the bank travel portal, these same flights are also priced at $4,456. If you tried booking either flight using your points in the bank’s travel portal, you’d need 445,630 points! Do you see how the value of your points is fixed at a meager 1 cent per point?

That’s a horrible deal. We really can’t stress on this enough.

But if you transfer your credit card points to an airline instead, you can book this same flight for much lower!

There are several ways you can book Turkish Airlines using points depending on which airline you transfer to (and consequently book through), but the most straight-forward way to do it is through Turkish Airlines itself.

In this case, you’d only need 65K points to book the exact same flight, and you’d have to pay only $217.80 out of pocket in taxes and fees! This is what an award flight search for this exact date shows us, via Turkish Airways’ website:

Isn’t the difference crazy? If you transfer your points, their value increases to 8.12 cents per point, compared to the 1cpp-1.5cpp your points average in the bank portal! If you have 400K points total, you can either book one of these flights in the bank tavel portal for 450K points, or you can theoretically book six of these flights (priced 65K points, and assuming you can find six award seats) using the same number of total points.

Most transfers occur at a 1:1 ratio, though this varies by bank and partner. A 1:1 ratio doesn’t sound too lucrative if you don’t have much context. To clarify, 1:1 ratio doesn’t mean that one credit card point gets you one cent. It means that one credit card point turns into one airline mile (or one hotel point). For example, transferring 60,000 American Express Membership Rewards points to British Airways would get you 60,000 British Airways Executive Club Avios.

The reason why this is a better deal than booking in the portal is because airlines and hotels price their award flights and award stays much differently than banks in the portal do! See the example above? Thanks to this 1:1 transfer ratio, you’d be able to book the flight for only 65K points.

This guide teaches you the step-by-step logistics of how to transfer your points. The first time is often the hardest as you try to navigate the bank’s online portal, but every subsequent transfer becomes easies as you get the hang of it!

Before You Transfer

The biggest mistake people make is that they transfer their points to a partner without knowing how they’re going to actually use their points.

If you want to transfer your points to an airline or hotel partner to maximize their value, you need to know that this is a two-step process. Transferring your points is step two. Step one is actually finding a specific way you plan to use them, and ensuring there’s award availability!

- Go to the airline or hotel website, log into your loyalty account, and search for an award flight / award stay. Find a specific flight or hotel stay available that’s reasonably priced. To be safe, find another one that works for you if your first choice fails (for example, if someone else books it while your points are transferring)

- Only then transfer your points from the bank to the airline or hotel partner!

Most points transfers are instant, but there are some notable exceptions which can introduce some margin of error. We always recommend finding at least two flights/hotel stays that work for you in case there’s a delay in your points transfer and someone else ends up snagging your first choice!

Importantly, transferring points is a one-way street. They are final transactions: once you transfer your points from the bank to a particular airline or hotel, you cannot transfer your points back to the bank.

Bottom line is:

Don’t just transfer your points without a purpose. Award availability is unpredictable and unreliable, which means you’ll only be successful if you have an actual game-plan.

How to Transfer Your Points: Step-by-Step

The process sounds elusive if you’ve never gone through it before, but it’s fairly simple. We’ll walk you through the exact steps for several major U.S. banks!

American Express

When you log into your American Express online banking portal, your upper menu will look like this; go to “Rewards and Benefits”:

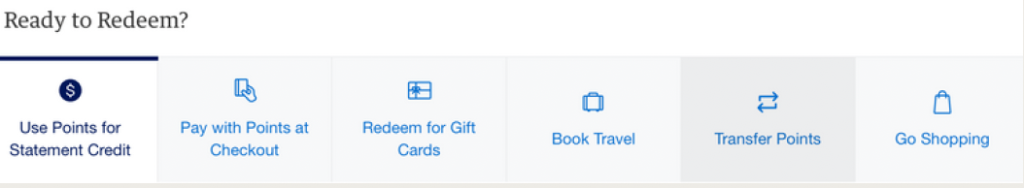

Scroll down until you get to “Ready to Redeem?” and choose “Transfer Points”:

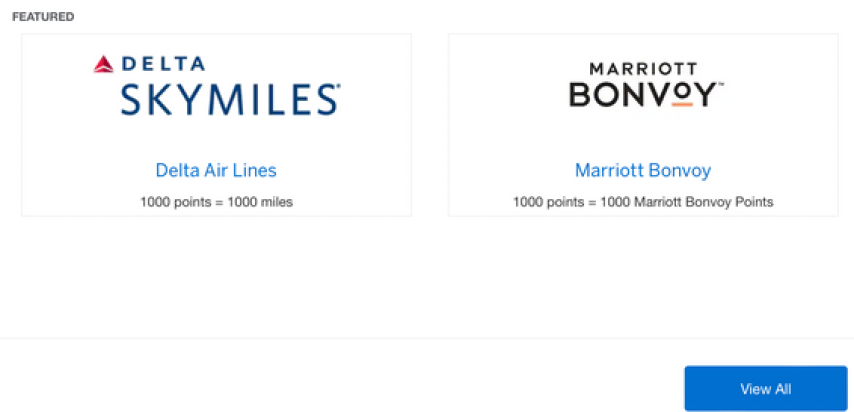

You may initially see only a view airline or hotel partners listed, so click “View All” to see the full list:

From there, enter your loyalty program number associated with the airline or hotel, as well as the name on the account, and choose the amount of points you’d like to transfer. Note that the account names must match.

Furthermore, make sure your Amex card earns tranferrable Membership Rewards points: such as the American Express Green Card® (non-affiliate), American Express® Gold Card (See rates and fees), The Platinum Card® by American Express, and more – each of these fit different spending needs and lifestyle habits.

(The Green and the Gold card are great options for daily spending, while the Platinum card is definitely a premium option for frequent travelers. This is not a card that’s optimized for daily spending – it’s specifically geared towards travel spending! Though the annual fees on these cards may be considered relatively high compared to others, pay attention to the wide array of benefits and credits that help offset the fee.)

Points earned through co-branded airline or hotel cards cannot be transferred.

Bilt

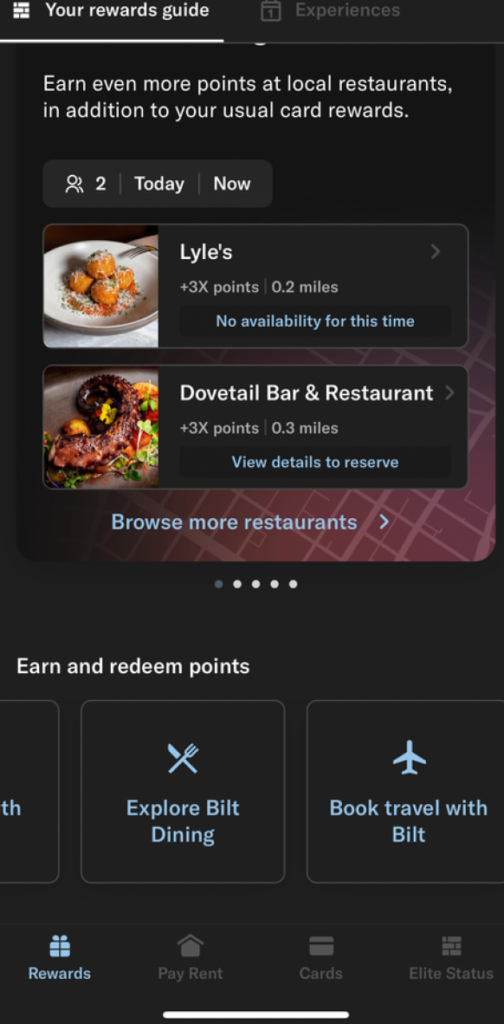

Log into the Bilt app from your phone and toggle to “Rewards” from the bottom menu. Scroll down to “Earn and Redeem Points” and select “Book Travel with Bilt”:

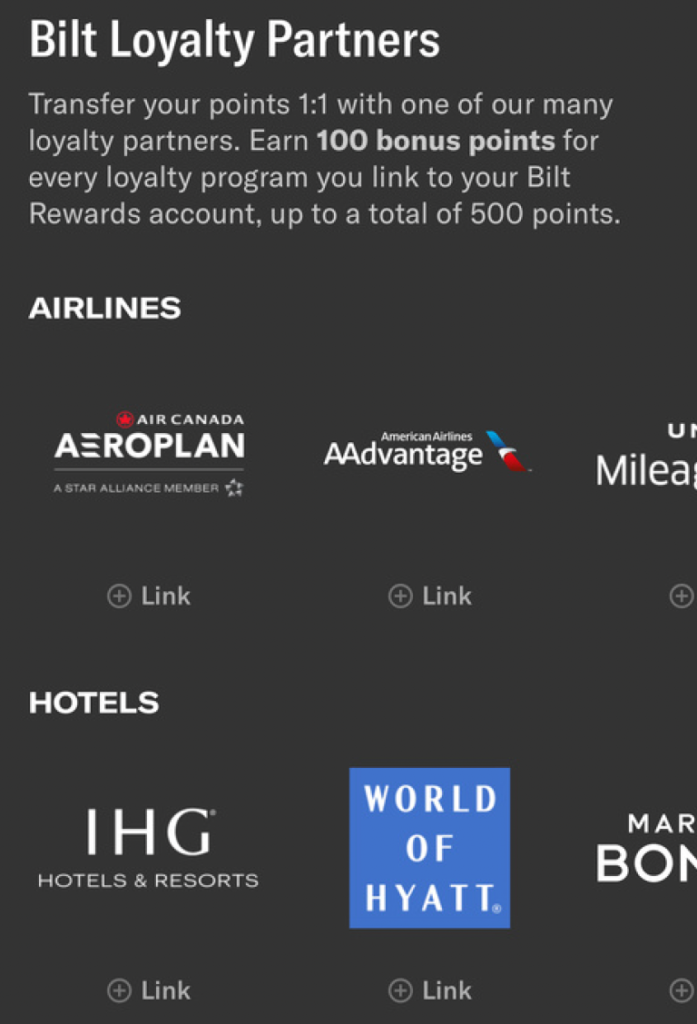

Scroll down until you get to “Bilt Loyalty Partners” and link the necessary accounts by clicking the “+” sign. Once your account is linked, you can transfer the necessary amount of points!

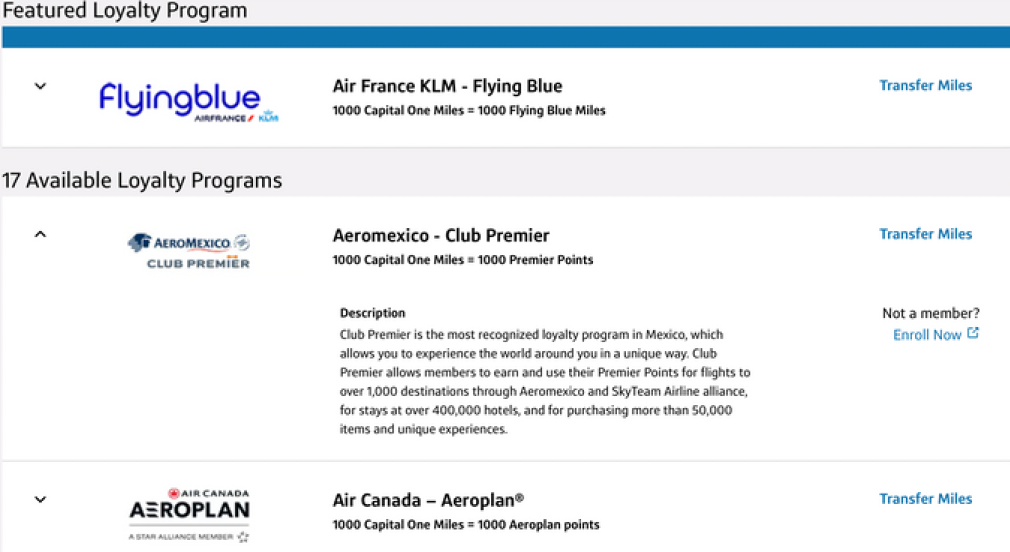

Capital One

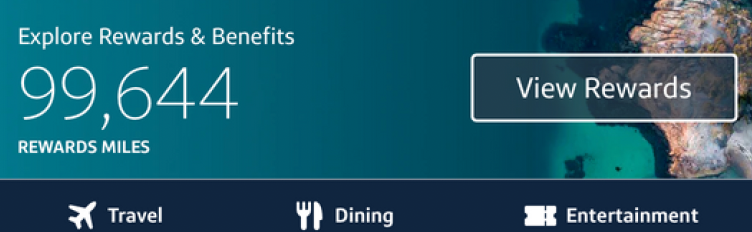

Once you log into your Capital One online banking account, to the left you should see an area tha tlooks like this; navigate to “View Rewards”:

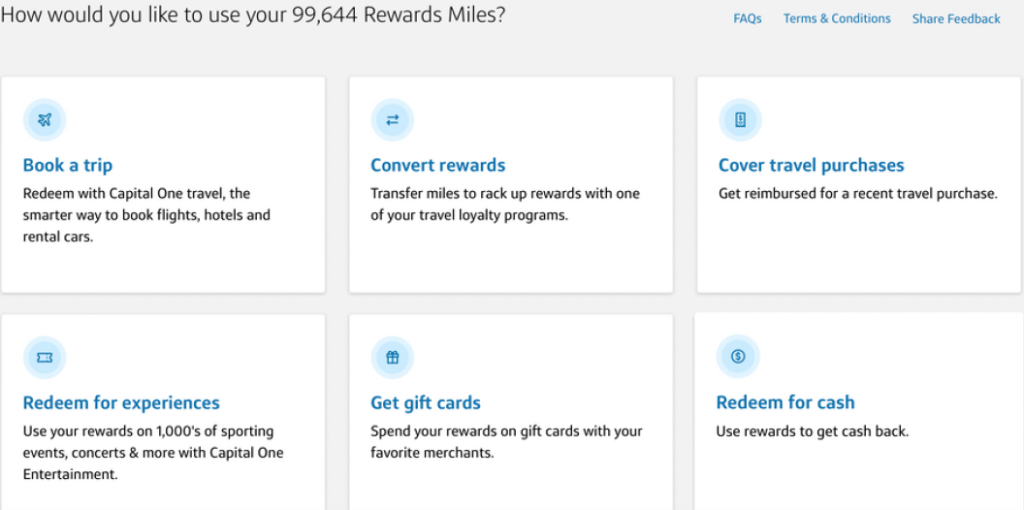

When you see the following options, choose “Convert Rewards”:

You’ll be led to a page with Capital One’s transfer partners. Once you’ve identified the airline or hotel you want to transfer your miles to, click on it. The dropdown menu will reveal an “Enroll Now” option.

You’ll need to enter your loyalty program number and name associated with the account – afterwards, you’re ready to transfer your miles!

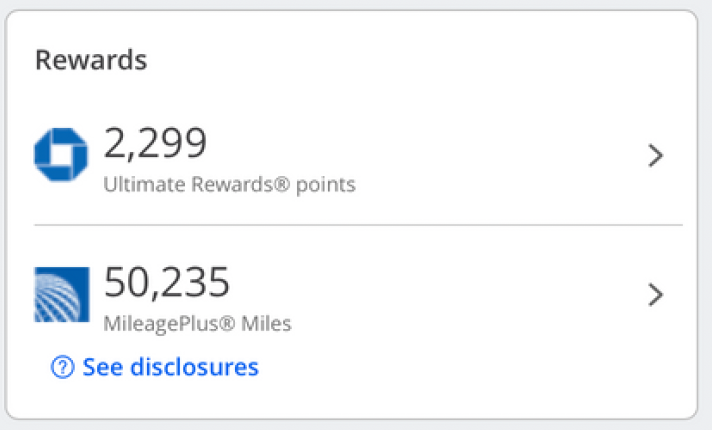

Chase

When you log into Chase’s online portal, look to the right and navigate to “Ultimate Rewards Points:”

Note that unless you have a Chase card that specifically earns Ultimate Rewards Points, you cannot transfer your points. If you only have Chase’s cashback cards, you can turn the cashback into points and transfer those points only if you additionally have a UR-earning card.

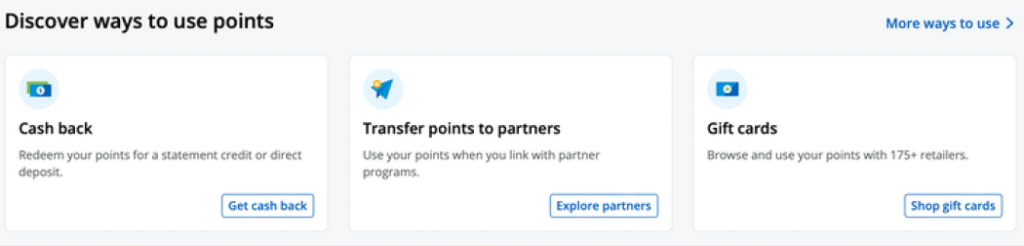

Keep scrolling down until you get to “Discover Ways to Use Your Points.” Click on “Explore Partners” under “Transfer Points to Partners”:

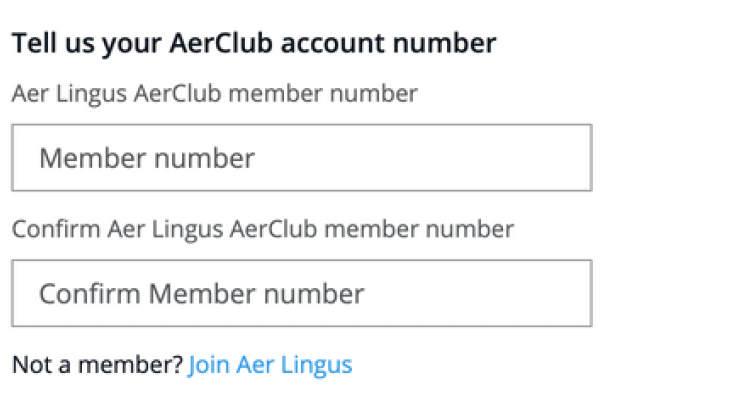

Once you find your desired airline or hotel, click on it and select “Transfer Points.” You’ll then be asked to link your accounts, so you’ll need to enter your loyalty account number and the name associated with it. Then you’re ready to transfer!

Citi

Log into your Citi Online Banking account, but make sure you’re specifically chosen an account that earns ThankYou points. Go to “More Ways to Redeem” in the top menu and choose “Points Transfer”

You’ll be led to a page listing Citi’s transfer partners. When you get to the one you want, select “Continue” and link your accounts. Again – you’ll need your membership number with the airline/hotel, and the names on the accounts must match.

Wells Fargo

Sign into your account and click on the Wells Fargo Rewards page. Hover over “Use Rewards” and select “Rewards Points Transfer”:

This should get you to the page listing Wells Fargo’s transfer partners. Here, you can link your loyalty program accounts to transfer your points!

Masterlist of Transfer Partners

| Transfer Partner | Airline Alliance | American Express MR | Bilt Rewards | Capital One Miles | Chase UR | Citi TYP | Wells Fargo Rewards |

| Aer Lingus AerClub | None, but has partners | 1:1 | 1:1 | 1:1 | 1:1 | ||

| Aeromexico Rewards | SkyTeam | 1:1.6 | 1:1 | 1:1 | |||

| Air Canada Aeroplan | Star Alliance | 1:1 | 1:1 | 1:1 | 1:1 | ||

| Air France/KLM FlyingBlue | SkyTeam | 1:1 | 1:1 | 1:1 | 1:1 | 1:1 | 1:1 |

| Alaska Airlines Mileage Plan | Oneworld | 1:1 | |||||

| ANA MileageClub | Star Alliance | 1:1 | |||||

| Avianca LifeMiles | Star Alliance | 1:1 | 1:1 | 1:1 | 1:1 | 1:1 | |

| British Airways Executive Club | Oneworld | 1:1 | 1:1 | 1:1 | 1:1 | 1:1 | |

| Cathay Pacific Asia Miles | Oneworld | 1:1 | 1:1 | 1:1 | 1:1 | ||

| Delta SkyMiles | SkyTeam | 1:1 | |||||

| Emirates Skywards | None, but has partners | 1:1 | 1:1 | 1:1 | 1:1 | 1:1 | |

| Etihad Guest | None, but has partners | 1:1 | 1:1 | 1:1 | |||

| EVA Air Infinity MileagePlus | Star Alliance | 4:3 | 1:1 | ||||

| Finnair Plus | Oneworld | 1:1 | |||||

| Hawaiian Miles | None, but has partners | 1:1 | |||||

| Iberia Plus | Oneworld | 1:1 | 1:1 | 1:1 | 1:1 | ||

| JetBlue TrueBlue | None, but has partners | 250:200 | 1:1 | 1:1 | |||

| Qantas Frequent Flyer | Oneworld | 1:1 | 1:1 | 1:1 | |||

| Qatar Airways Privilege Club | Oneworld | 1:1 | 1:1 | ||||

| Singapore Airlines KrisFlyer | Star Alliance | 1:1 | 1:1 | 1:1 | 1:1 | ||

| Southwest Rapid Rewards | None | 1:1 | |||||

| TAP Miles&Go | Star Alliance | 1:1 | |||||

| Thai Royal Orchid Plus | Star Alliance | 1:1 | |||||

| Turkish Airlines Miles & Smiles | Star Alliance | 1:1 | 1:1 | 1:1 | |||

| United MileagePlus | Star Alliance | 1:1 | 1:1 | ||||

| Virgin Atlantic Flying Club | SkyTeam | 1:1 | 1:1 | 1:1 | 1:1 | 1:1 |

IMPORTANT: Always check availability and transfer times before moving any your points to partners.

Transfer Bonuses

Banks will sometimes run limited-time promotions that give you extra points upon transfer. For example, a bank may run a one-month 20% transfer bonus to Air Canada: in this case, if its transfer ratio was originally 1:1, during this promotion period the transfer ratio will turn to 1:1.2. This also doesn’t sound like a lot until you compound the numbers and do the math: you’d only need to transfer 50,000 credit card points to get 60,000 Air Canada Aeroplan miles, so this 20% bonus can save you 10,000 points on booking a flight!

How to Book the Best Business and First Class deals With Points

Bottom line is, if you want to maximize your credit card points for nearly free luxury travel, avoid redeeming them through your bank’s travel portal at just 1 cent per point. Instead, transfer them to airline loyalty programs, where you can unlock massive value on premium flights.

Here’s why transfers are better:

Some airline partners offer outsized redemption value, allowing you to book $10,000+ first-class flights for under 100,000 points—a fraction of what you’d need through a bank portal (where the same flights could cost nearly 1 million points!).

Example: An Emirates First Class flight from New York to Milan costs $12,000+ in cash, but by transferring your points to Emirates Skywards, you can book it for just 102,000 points and less than $106 out of pocket! So why would you ever willingly pay 1,020,000 points in the bank travel portal for the exact same flight?

Of course, finding these deals takes strategy—but that’s where we come in. We track the best business and first-class award redemptions every week so you don’t have to! So if you want to start booking luxury flights for nearly free, sign up for our expertly-curated award flight newsletter and start booking the same deals that we do.

Note: Opinions expressed here are ours alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

Note: Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. American Express Green Card® is not part of our affiliate network.