Chase Sapphire Preferred® CARD Review (2025): Why This Is the Best Starter Travel Credit Card

The Chase Sapphire Preferred® Card is often considered the best travel credit card for beginners—and for good reason. With a generous welcome offer, flexible redemption options, and valuable travel perks, this card makes it easy to maximize your points for flights, hotels, and more.

Chase Sapphire Preferred®: At a Glance

The Chase Sapphire Preferred® Card is one of our favorite beginner credit cards because:

- its welcome bonus is extremely generous and the minimum spend requirements isn’t too high

- its additional perks help offset the $95 annual fee further

- its travel benefits are some of the best out there

- its bonus earning categories are great for everyday spending!

| Feature | Details |

|---|---|

| Welcome Offer | Earn 60,000 Chase Ultimate Rewards® points after spending $4,000 in the first 3 months (worth at least $750 in travel). |

| Annual Fee | $95 |

| Earning Rates | 5X on travel through Chase, 3X on dining & streaming, 2X on all other travel, 1X on everything else |

| Travel Perks | Trip cancellation/interruption insurance, primary car rental insurance, no foreign transaction fees |

| Best For | Travel rewards for beginners, frequent flyers, dining enthusiasts, anyone looking for a low-fee rewards card |

Let’s unpack these in more detail!

HUGE WELCOME OFFER WORTH $750+ IN TRAVEL

The 60,000-point bonus is one of the most valuable in the industry. When redeemed through Chase Ultimate Rewards, these points are worth at least $750 toward travel. But if you use our strategies and leverage Chase’s airline and hotel partnerships, you’ll be able to at least 2x the value of your points.

We’ll show you several examples of how this works below!

ADDITIONAL PERKS

In addition to earning 60K points, you also get a $50 annual Chase Travel Hotel credit – in a given year, this can effectively bring down the value of the card’s annual fee down to only $45/year.

Additionally, you can enjoy complimentary DashPass access! It includes $0 delivery fees and lower service fees for a minimum of one year when you activate this offer by December 31, 2027.

TRAVEL BENEFITS

The Chase Sapphire Preferred® Card has some of the best travel benefits out there. These include:

- No foreign transaction fees

- Baggage delay insurance – you’ll get reimbursed for essential purchases (like clothing and toiletries) if you baggage has been delayed more than six hours, up to $100 a day for 5 days

- Lost luggage reimbursement – if the carriers loses or damages your check-in or carry-on luggage, you may be eligible for up to $3,000 per passenger affected (this includes immediate family members traveling with you)

- Trip cancellation / interruption insurance – whether the cause is sickness or severe weather, you may be reimbursed up to $10,000 per person or $20,000 per trip for pre-paid, non-reunfdable travel expenses: these includes flights, hotels, tours, etc.

- Trip delay reimbursement – if your journey is delayed more than 12 hours or ends up requiring an overnight stay, you may reimbursed up to $500 per ticket for lodging and meals.

- Primary auto rental collision damage waiver – highlighting primary because most cards offer only secondary! This means you can decline the rental company’s collision insurance and charge the entire rental to your card to get its coverage. You may be reimbursed up to the cash value of the vehicle, but note that coverage may exclude certain high-value cars.

EARNING CATEGORIES

- Earn 5 points per dollar spent on travel purchased through Chase Travel℠

- Earn 3 points per dollar spent on dining (including take-out), select streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs)

- Earn 2 points per dollar spent on all travel purchases, including public transit, taxi, etc.

- Earn 1 point per dollar spent on all other purchases

WHY APPLY FOR THE CARD

To start with, you don’t want to miss the welcome offer: 60,000 points can take you pretty far, whether you’re traveling in coach or business class.

Beyond that, its bonus earning categories are pretty great, with some common spending categories (such as streaming, dining, and online groceries) earning up to 3x points per dollar spent!

Finally, this card is truly a go-to when it comes to making sure you’re covered in the event of a trip cencellation/delay, and its primary rental car insurance is better than what most competitors cards offer.

WHAT TO DO IF YOU APPLIED WHILE THE OFFER WAS LOWER

Worry not! If you applied within the last 2-3 months while the offer was lower, it’s worth using the secure message portal in your Chase account and asking customer service whether they are willing to match this higher offer!

DETERMINING YOUR ELIGIBILITY

5/24 RULE

As any of Chase’s cards, you need to be under 5/24 to apply.

If you don’t know Chase’s 5/24 Rule is, it basically means that to qualify for a Chase credit card (whether personal or business), you need to have opened less than five new cards in the last 24 months. All personal credit cards on your credit report within the last 24 months count towards your 5/24 status, even obscure ones like store cards.

Unfortunately, “new accounts” also include cards that you’ve been added to as an authorized user. So if your P2 added you as an authorized user on their Capital One Venture X Rewards Credit Card last summer to get an additional Priority Pass membership or TSA PreCheck credit, it’ll still count towards your 5/24 status.

Fortunately, business credit cards do not count towards your 5/24 status! Business credit cards from TD Bank, Discover, and UBS Bank are notable exceptions and do count your 5/24 status. So do select business credit cards from Capital One (though importantly, the Venture X and Capital One Spark Cash Plus don’t count towards 5/24).

ONE SAPPHIRE RULE

Additionally, you may have either the Chase Sapphire Preferred® Card or the Chase Sapphire Reserve®: not both at the same time. This means if you already have the Sapphire Reserve, you are not eligible for the Sapphire Preferred.

48-MONTH RULE

You are eligible to earn this bonus if you have not received a Sapphire card’s welcome bonus in the last 48 months. If you currently have a Sapphire card whose bonus you earned more than 48 months ago, you may be able to downgrade it to a no-annual-fee Freedom card or cancel it entirely, then reapply for the Chase Sapphire Preferred at a later point (minimum 1-2 weeks later).

2/30 RULE

Finally, remember Chase’s 2/30 rule! According to the 2/30 rule, you can only have two applications every 30 days or else you’ll automatically be rejected. Unfortunately, Chase’s business card do count towards this rule (even though they don’t count the 5/24 rule), so if you recently applied for any other Chase cards – whether personal or business – make sure you’re compliant before you apply for this one!

CHASE TRANSFER PARTNERS

Chase transfers to 11 airlines and 3 hotels.

| Transfer Partner | Ratio | Alliance |

| Aer Lingus AerClub | 1:1 | None, but has partners |

| Air Canada Aeroplan | 1:1 | Star Alliance |

| Air France/KLM FlyingBlue | 1:1 | SkyTeam |

| British Airways Executive Club | 1:1 | Oneworld |

| Emirates Skywards | 1:1 | None, but has partners |

| Iberia Plus | 1:1 | Oneworld |

| JetBlue TrueBlue | 1:1 | None, but has partners |

| Singapore Airlines KrisFlyer | 1:1 | Star Alliance |

| Southwest Airlines Rapid Rewards | 1:1 | None |

| United Airlines MileagePlus | 1:1 | Star Alliance |

| Virgin Atlantic Flying Club | 1:1 | SkyTeam |

| Transfer Partner | Ratio |

| IHG Rewards | 1:1 |

| Marriott Bonvoy | 1:1 |

| World of Hyatt | 1:1 |

HOW TO TRANSFER YOUR CHASE ULTIMATE REWARDS POINTS TO AIRLINE AND HOTEL PROGRAMS

If you’ve never transferred your points to an airline or hotel loyalty program before: don’t worry, it becomes much easier after the first time you do it. Before you start, though: never transfer your points before finding an award flight/stay! Keep your points with Chase until you find one.

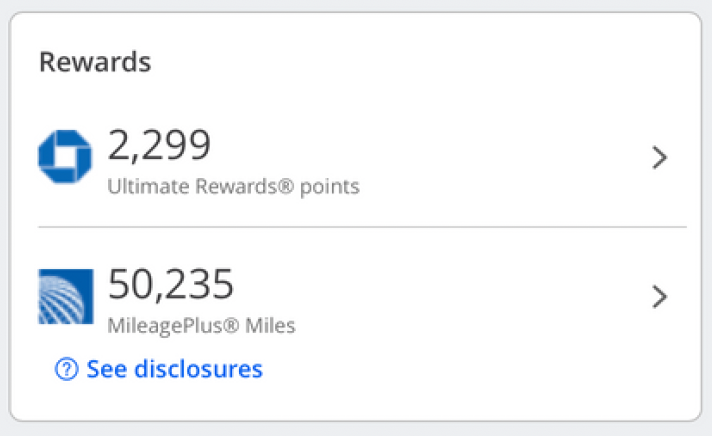

Once you’ve found an award flight or award hotel stay using points, log into your Chase online banking account. Look to the right and navigate to “Ultimate Rewards Points”:

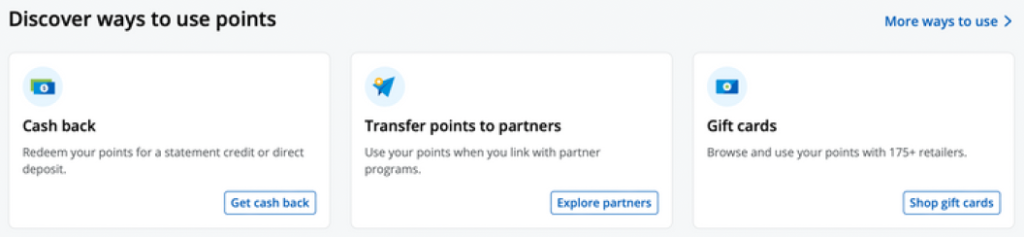

Keep scrolling down until you get to “Discover more ways to use your points.”

Click on “Explore partneres” under “Transfer points to partners”:

You’ll see a list of airline and hotel partners who Chase allows you to transfer your Ultimate Rewards points to. Navigate to the one you want to transfer to, click on it, and select “Transfer points.” You’ll be prompted to link your accounts, so enter your hotel/airline loyalty program account number and your name, and you’re all set – you’re able to select the amount of points you want to transfer!

IF YOU’RE WONDERING HOW TO USE YOUR POINTS…

Although you could just cash this welcome offer out for $750, we strongly recommend transferring your points to maximize their value! Specifically, we recommend leveraging those points by transferring them to Chase’s airline and hotel partners, which allows you to maximize their value.

Why? Because 60,000 can stretch much further than the $750 cash back you’d otherwise get.

Here are three examples:

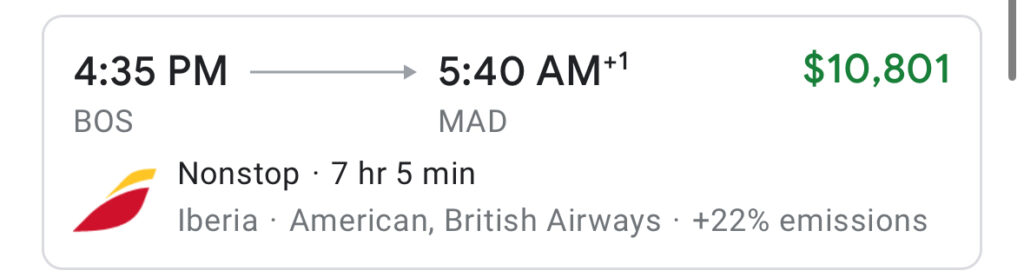

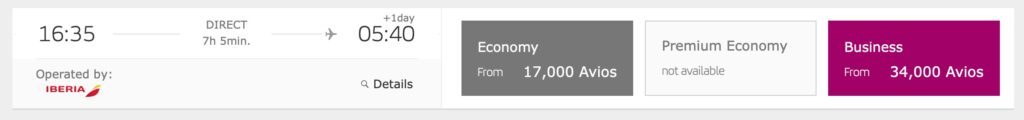

- Look at this $10,801 Iberia business class flight from Boston to Madrid. You can book it for only 34,000 Iberia Plus Avios!

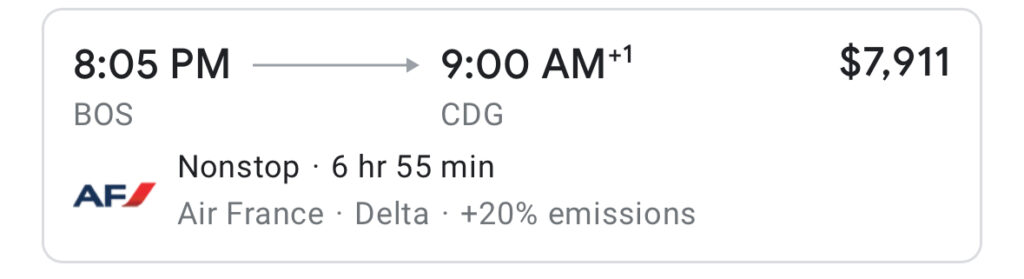

2. This $7,911 Air France business class flight from Boston to Paris costs only 50,000 Air France/KLM FlyingBlue miles!

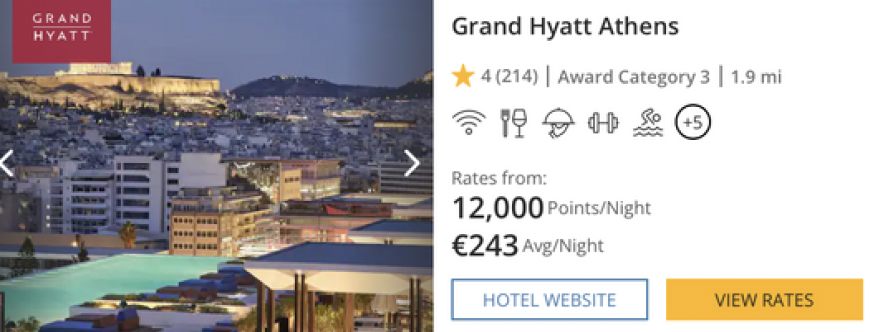

3. This Hyatt hotel stay in Athens would cost you only 12K points a night compared to ~$266!

Note: Opinions expressed here are ours alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

All information about Chase Credit Card Products has been collected independently by themilescouple.com.

Chase Credit Card Products are no longer available through themilescouple.com