ELEVATED WELCOME OFFER ON CHASE INK BUSINESS UNLIMITED® CREDIT CARD

The Chase Ink Business Unlimited® Credit Card is a top choice among Chase’s business credit cards. With no annual fee and an exceptional elevated welcome offer of 75,000 bonus points after spending $6,000 within the first three months of account opening, this card’s value is truly unmatched!

NOT JUST A CASHBACK CARD

This card is marketed as a cashback credit card, but if you have the Chase Sapphire Preferred® Card, the Chase Sapphire Reserve®, or the Chase Ink Business Preferred® Credit Card – then you can turn its cashback into points, such that $750 cashback equals 75K points.

This means that instead of earning an unlimited 1.5% cash back on every purchase made on this card, you could earn 1.5 points per dollar spent!

If you don’t currently have any of these other cards: don’t worry. After meeting the minimum spend requirement, you’ll still earn these points: they just won’t be transferrable until you open one of these Chase cards! To gain the ability to transfer these points, after you earn this welcome bonus you can then apply for a staple card such as the Chase Sapphire Preferred® Card to not only earn another 60K welcome offer, but also (1) have a solid beginner card that earns bonus points on daily spending categories (such as 3x ondining out, online groceries, and select streaming services – all of which the Sapphire Preferred earns!), and (2) gain the ability to transfer the 75K points you’ve earned from the Ink Unlimited to Chase’s airline and hotel partners, listed at the bottom of this post!

WHAT YOU EARN ON SPENDING

Beyond earning 75,000 bonus points as part of the welcome offer if you have another Ultimate Rewards-earning card, you earn the following points on your spending:

- Unlimited 1.5x points per dollar spent on every purchase made on this card

You can find the full details of the card’s earnings and benefits here.

WHY APPLY FOR THE CARD

To start with, you don’t want to miss the 75K welcome offer! Whether you own a LLC or not, the unlimited 1.5x earnings across all spending categories make this card an excellent addition to your wallet thanks to the simple rewards structure. Importantly, though: you need to have a card like The Chase Ink Business Preferred®, Chase Sapphire Preferred®, or Chase Sapphire Reserve® in order to turn the cashback into transferrable points.

The card doesn’t have an annual fee! If you apply for the card and are approved, you can keep it in your wallet and leverage that extra line of credit at no cost.

NOT JUST FOR BUSINESS OWNERS WITH LLCS

Don’t write off this business credit card if you don’t have a registered LLC! What most people don’t know is that they’re eligible to apply if they earn any sort income from “side hustles” – whether it’s setting up a lemonade stand on weekends, dog-walking, baby-sitting, selling second-hand furniture on Facebook Marketplace or clothes on Depop, driving on Uber, renting out their basement, freelance writing, etc.

If you have any sort of “side hustle” like the ones listed above, you qualify for this business credit card as Sole Proprietor, and you can apply using your SSN instead of an EIN.

ELIGIBILITY

As any of Chase’s cards, you need to be under 5/24 to apply.

If you don’t know Chase’s 5/24 Rule is, it basically means that to qualify for a Chase credit card (whether personal or business), you need to have opened less than five new cards in the last 24 months. All personal credit cards on your credit report within the last 24 months count towards your 5/24 status, even obscure ones like store cards.

Unfortunately, “new accounts” also include cards that you’ve been added to as an authorized user. So if your P2 added you as an authorized user on their Capital One Venture X Rewards Credit Card last summer to get an additional Priority Pass membership or TSA PreCheck credit, it’ll still count towards your 5/24 status.

Fortunately, business credit cards do not count towards your 5/24 status! Business credit cards from TD Bank, Discover, and UBS Bank are notable exceptions and do count your 5/24 status. So do select business credit cards from Capital One (though importantly, the Venture X and Capital One Spark Cash Plus don’t count towards 5/24).

Importantly, you are still eligible to apply for the Ink Business Unlimited even if you already have another Ink product, such as the Chase Ink Business Cash® Credit Card or the Chase Ink Business Preferred® Credit Card. You can have all three in your wallet at the same time! As long as you’re under 5/24, you’re also eligible to apply even if you’re recently already had the card and closed it.

Finally, remember Chase’s 2/30 rule! According to the 2/30 rule, you can only have two applications every 30 days or else you’ll automatically be rejected. Unfortunately, Chase’s business card do count towards this rule (even though they don’t count the 5/24 rule), so if you recently applied for any other Chase cards – whether personal or business – make sure you’re compliant before you apply for this one!

HOW TO APPLY

Filling out an application for a business credit card looks a little bit different compared to a personal credit card, but we’ve got you covered. If you’ve never applied for one before and you don’t yet have a registered LLC but still qualify through another stream of income, this is how you should fill out your application:

- Legal name of business: your legal name

- Business name on card: your legal name

- Business mailing address: your mailing address

- Business type: sole proprietor

- Tax identification number: your social security number, though you could easily create an EIN through the IRS if you wanted to – the process is quick and free

- Business category: pick the one that best describes what you do

- Number of employees: 1

- Annual business revenue: your projected annual revenue – it’s 100% okay if this is zero or generally a low number!

- Years in business: number of years you’ve worked like this – it doesn’t matter if you haven’t been making a profit

- Gross annual income: total income of your household – does not have to be just from this income stream!

If your application doesn’t get immediately approved, it’s likely that it was sent in for further review. In this case, you should expect a call from Chase within a few business days – they make ask you some of these questions again (so make sure you keep a copy of your application on file!) or they may ask for further clarification on what you do. Either way, especially if you already have an existing relationship with Chase, don’t hesitate to tell them how excited you are to get this card for its points-earning opportunities and wide variety of benefits!

Remember that once you have the card, you also don’t have to put only your business expenses on it. It may help for personal accounting purposes to make tax season easier, but the banks really don’t care whether you charged your personal travel or shopping to your business credit card.

CHASE TRANSFER PARTNERS

Chase transfers to 11 airlines and 3 hotels.

| Transfer Partner | Ratio | Alliance |

| Aer Lingus AerClub | 1:1 | None, but has partners |

| Air Canada Aeroplan | 1:1 | Star Alliance |

| Air France/KLM FlyingBlue | 1:1 | SkyTeam |

| British Airways Executive Club | 1:1 | Oneworld |

| Emirates Skywards | 1:1 | None, but has partners |

| Iberia Plus | 1:1 | Oneworld |

| JetBlue TrueBlue | 1:1 | None, but has partners |

| Singapore Airlines KrisFlyer | 1:1 | Star Alliance |

| Southwest Airlines Rapid Rewards | 1:1 | None |

| United Airlines MileagePlus | 1:1 | Star Alliance |

| Virgin Atlantic Flying Club | 1:1 | SkyTeam |

| Transfer Partner | Ratio |

| IHG Rewards | 1:1 |

| Marriott Bonvoy | 1:1 |

| World of Hyatt | 1:1 |

HOW TO TRANSFER YOUR CHASE ULTIMATE REWARDS POINTS TO AIRLINE AND HOTEL PROGRAMS

If you’ve never transferred your points to an airline or hotel loyalty program before: don’t worry, it becomes much easier after the first time you do it. Before you start, though: never transfer your points before finding an award flight/stay! Keep your points with Chase until you find one.

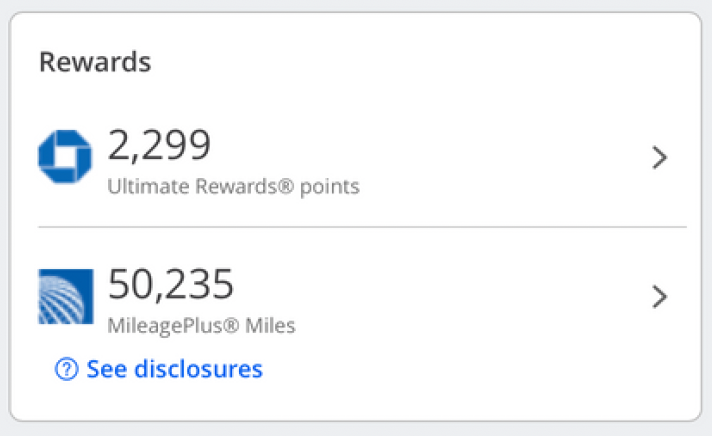

Once you’ve found an award flight or award hotel stay using points, log into your Chase online banking account. Look to the right and navigate to “Ultimate Rewards Points”:

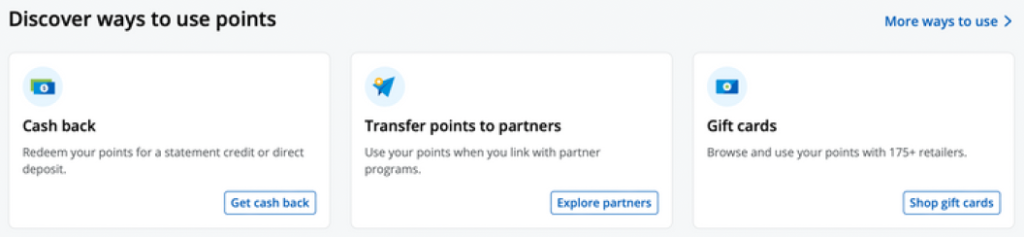

Keep scrolling down until you get to “Discover more ways to use your points.”

Click on “Explore partneres” under “Transfer points to partners”:

You’ll see a list of airline and hotel partners who Chase allows you to transfer your Ultimate Rewards points to. Navigate to the one you want to transfer to, click on it, and select “Transfer points.” You’ll be prompted to link your accounts, so enter your hotel/airline loyalty program account number and your name, and you’re all set – you’re able to select the amount of points you want to transfer!

IF YOU’RE WONDERING HOW TO USE YOUR POINTS…

Although you could just cash this welcome offer out for $750, we strongly recommend converting it to 75,000 bonus points. Specifically, we recommend leveraging those points by transferring them to Chase’s airline and hotel partners, which allows you to maximize their value.

Why? Because 75,000 can stretch much further than the $750 cash back you’d otherwise get.

Here are three examples:

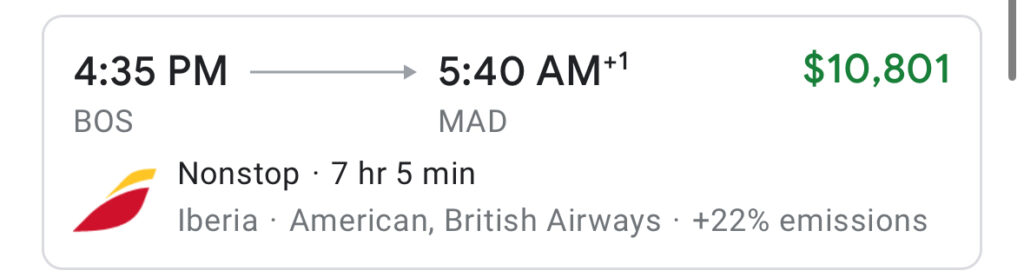

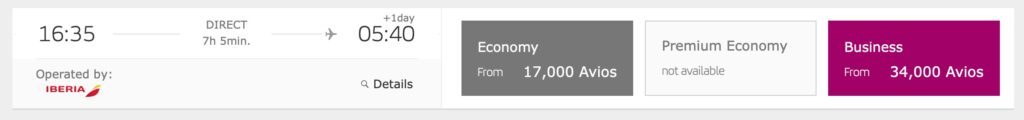

- Look at this $10,801 Iberia business class flight from Boston to Madrid. You can book it for only 34,000 Iberia Plus Avios!

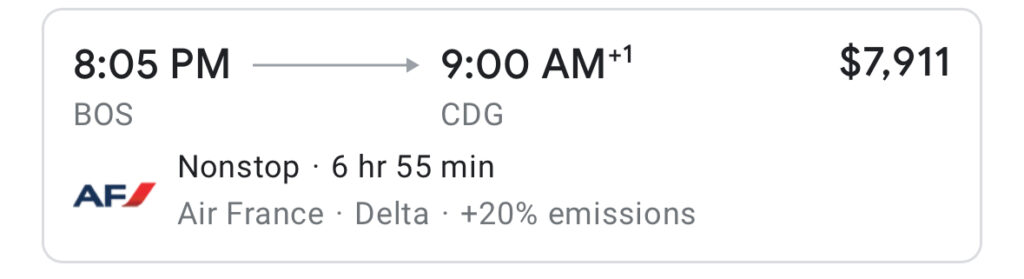

2. This $7,911 Air France business class flight from Boston to Paris costs only 50,000 Air France/KLM FlyingBlue miles!

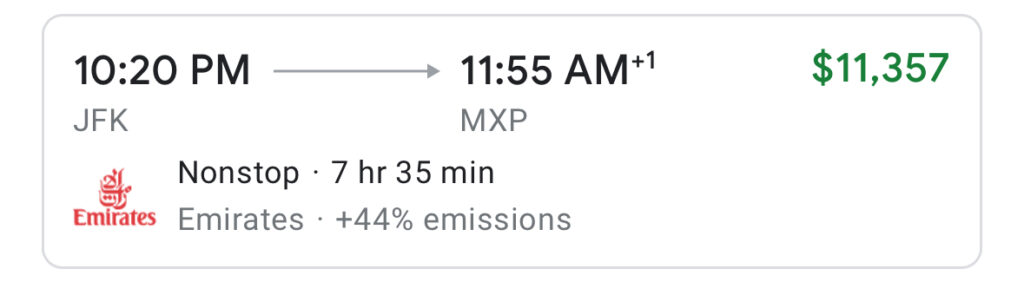

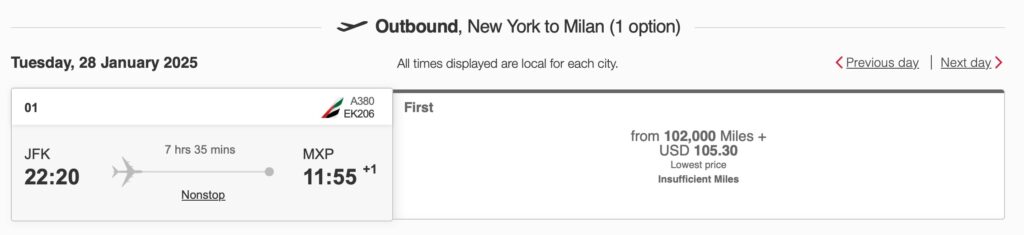

3. This $11,357 Emirates first class flight from New York to Milan costs 102,000 Emirates Skywards miles! And yes – JFK to MXP operates on an A380, so you also get an on-board bar on the upper deck of the plane, as well as an on-board shower. After earning the 75K welcome offer, you only need to earn 12K more points to book this flight!

Click here to learn more about the Chase Ink Business Unlimited® Credit Card!

Note: Opinions expressed here are ours alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.