The American Express® Gold Card Just Got A “Refresh”

A “refresh” refers to changes in its annual fee and benefits. This is one of the the most popular personal credit card amongst consumers who enjoy racking up rewards, so it’s a big deal!

While the card used to cost only $250, we’ve now witnessed a 30% increase to $325 total (See rates & fees)! Even though the card’s annual fee increased by $75 to a whopping $325 per year, don’t let that deter you from keeping it in your wallet, or applying for it if you don’t already have it. The annual fee increase came hand-in-hand with more benefits: while the Gold’s statement credits used to amount to $240 annually, they now add up to $424. Let’s compare what’s different:

| American Express Gold (old) | American Express Gold (refresh) | |

| Annual Fee | $250 | $325 |

| Bonus Categories | – 4x points per dollar at restaurants worldwide – 4x points per dollar at U.S. supermarkets (up to $25,000 per year, then 1x) – 3x points per dollar on flights booked directly with the airline or with Amex Travel – 1x point per dollar on all other purchases | – 4x points per dollar at restaurants worldwide (up to $50,000 per year, then 1x) – 4x points per dollar at U.S. supermarkets (up to $25,000 per year, then 1x) – 3x points per dollar on flights booked directly with the airline or with Amex Travel – 1x point per dollar on all other purchases |

| Statement Credits | – Up to $120 in annual Uber Cash: $10 monthly in Uber Cash. You must add the card to the Uber app to receive the Uber Cash benefit. You must have downloaded the latest version of the Uber App and your eligible American Express Gold Card must be a method of payment in your Uber account. The Amex benefit may only be used in United States. – Up to $10 monthly in dining statement credits when you pay with the Amex Gold Card at participating dining partners (Shake Shack, Milk Bar, The Cheesecake Factory, Goldbelly, Grubhub, Wine.com). Enrollment through the Amex website is required. | – Up to $120 in annual Uber Cash: $10 in Uber Cash monthly for Uber Eats and Uber rides in the U.S. You must add the card to the Uber app to receive the Uber Cash benefit. You must have downloaded the latest version of the Uber App and your eligible American Express Gold Card must be a method of payment in your Uber account. The Amex benefit may only be used in United States. – Up to $10 monthly in dining statement credits when you pay with the Amex Gold Card at participating dining partners (However, note change in vendors: Shake Shack and Milkbar are no longer on the list, Five Guys is a new addition). Enrollment through the Amex website is required. – Up to $100 annually in Resy credits (two $50 biannual credits) when dining at Resy U.S. restaurants. Enrollment through the Amex website is required. – Up to $84 annually in Dunkin credits ($7 monthly). Enrollment through the Amex website is required. |

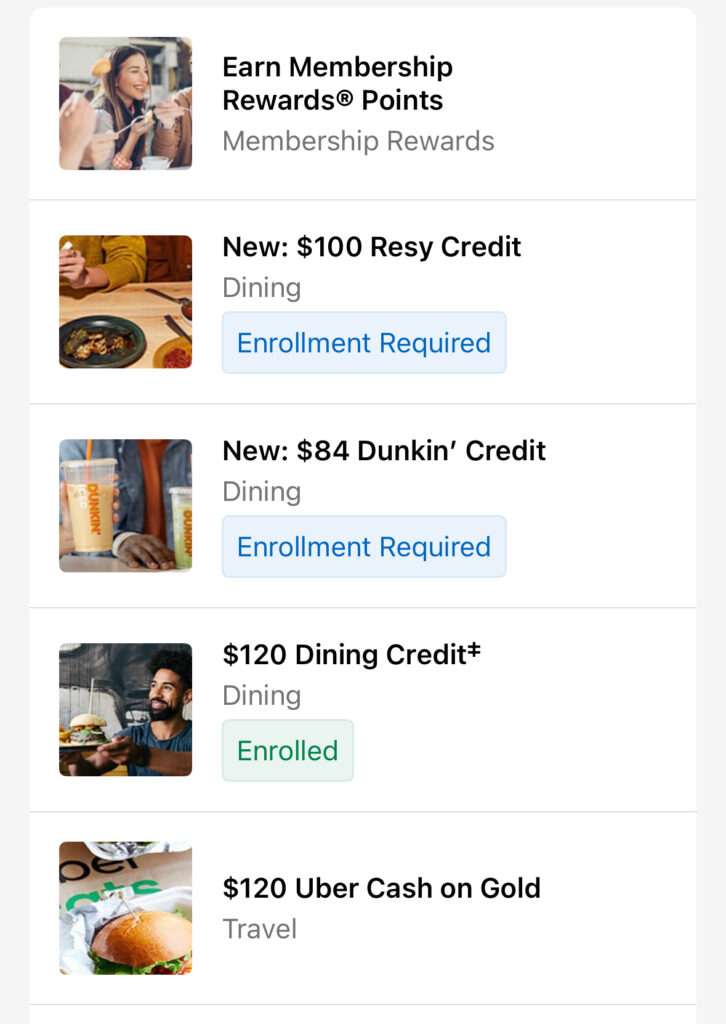

Note that the new Resy and Dunkin statement credits require enrollment as well! Log into your account, tap “Membership”, and select “View All”:

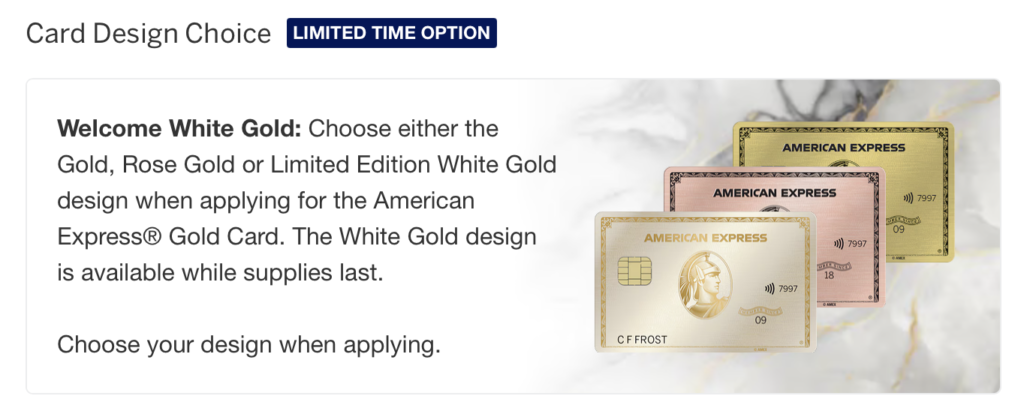

Limited-Time White Gold Design

Moreover, the card’s visuals are also getting a limited-time refresh! The all-new “white gold” design will be available for order until supplies last. As an existing cardholder, you can easily order one by choosing “Replace Card” once you log into the Amex app or website. If you don’t see the white gold option listed, pivot to the “Contact Us via Chat” option and ask a representative to fulfill the order for you!

What We Think

The 30% hike in the Gold card’s annual fee isn’t that staggering when you consider all the additional statement credits Amex has included in its array. The $7 a month in Dunkin credits alone more than makes up for the increase, and people will find that they will easily max out the new $100 annual Resy credit!

However, the $325 annual fee does become staggering when you compare it to the Capital One Venture X Rewards Credit Card, Capital One’s most premium product, which costs only $70 more. These two cards may not be direct competitors, given that they offer vastly different bonus earning rates and benefits, but the minute difference in their fees really underscores this:

At the end of the day, the American Express Gold is a premium product.

Alternatives

If you’re on the fence about keeping your American Express Gold card following this refresh, there are three potential routes you can take.

The first option is to keep your American Express Gold, and just stay on top of maxing out your monthly credits. Additionally, make sure that you ask for a retention offer once your new annual fee hits – that way, you can minimize the cost of keeping your Gold card for an extra year. Amex is one of the most generous banks when it comes to offering points or statement credits for the purposes of client retention! Currently, there are data points that offers have gone as high as 30K points (after spending a certain amount in a certain timeperiod, terms similar to a welcome offer), but we’re still uncertain whether the new annual fee also means higher retention offers!

The second option is to remain loyal to American Express and its Membership Rewards program, but pivot to a lower annual fee card. The Gold’s refresh may actually make the American Express Green Card® more appealing to people who want want to remain loyal to Amex and keep earning extra points on dining, but don’t necessarily want to pay such a high annual fee or keep track of all these credits. Although the Amex Green doesn’t earn extra points in supermarkets like the Gold, it may still provide a good alternative to keeping the Gold card! The Green card earns points at fairly similar rates, such as 3x points per dollar in dining worldwide, 3x on transit, and 3x on travel. At only $150 a year, the Amex Green can be considered the Gold card’s much more affordable younger brother.

Lastly, let’s not forget Capital One appealing ecosystem, whose card synergies are not as well-known as other banks’. If you have the Capital One Venture Rewards Credit Card ($95) or the Capital One Venture X ($395), you not only earn Capital One miles on your daily spending, but you also have the ability to turn your no-annual-fee cashback rewards (from cards like the Capital One SavorOne Cash Rewards Credit Card, Capital One QuickSilver Cash Rewards Credit Card, and more) into miles! If you don’t understand what this means yet, let’s go over an example.

Let’s say you have the Capital One Venture Rewards card ($95) and the Capital One SavorOne Cash Rewards (no annual fee). For just $95 a year (the cost of carrying the Venture Rewards card), you can earn:

- Via SavorOne: 10x miles per dollar on Uber and Uber Eats (through November 14, 2024)

- Via Venture Rewards: 5x miles per dollar on hotels and rental cars booked in the Capital One Travel portal

- Via Venture Rewards: 5x miles per dollar on Capital One Entertainment purchases (through December 31, 2025)

- Via SavorOne: 3x miles per dollar on dining, grocery stores, entertainment, popular streaming services

- Via Venture Rewards: 2x miles per dollar on all other purchases (through the Venture Rewards’ benefits).

As you can see, these are staggering rates considering that the total you’d pay in annual fees is only $95 (if you have the Venture Rewards) or $395 (if you have the Venture X).

Unfortunately, as of July 16, 2024, Capital One no longers offers the Capital One Savor Cash product to new applicants. However, if you are an existing Savor One cardholder, you can earn 4x miles per dollar on dining, eligible streaming services, and entertainment, and 3x miles per dollar at grocery stores, if you combine your Savor Cash card with a Venture card!

Even if you didn’t have the chance to apply for a Savor Cash card while it was still available to new applicants, the Savor One (whose earning rates we show above) is still a great alternative.

Bottom Line

If you don’t like milking credits and having to keep track of what you’ve used every month, keeping the American Express Gold “refresh” card won’t be ideal for you. However, if you’re able to leverage all the credits every single month, then you’ll be getting $424 in value annually – which still exceeds the annual fee by $99!

The new luxe white gold card visuals are gorgeous, but don’t let that be the reason that you keep this card. Take a look at your monthly spending habits and determine whether you’ll get your money’s worth out of this card. Don’t forget that you can ask for a retention offer if you’re on the fence, and even if you end up closing this card, don’t worry! There are still great alternative products – whether with Amex or with other banks – who can allow you to keep your bonus earning categories fairly similar.

Note: Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. American Express Green Card® is not part of our affiliate network.

Note: Opinions expressed here are ours alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.